Singapore industrial investment sales more than double in Q1 2021

Two key transactions underpinned the S$906.1m worth of investment purchases in the quarter.

With the economy on the mend with positive news from the vaccine distribution, controlled easing of travel restrictions as well as the return of workers to their workplaces, Knight Frank says investment sales activity picked up in the first quarter of the year, with the residential sector leading the string of deals. Investment deals amounted to some S$3.8 billion in Q1 2021, representing an uptick of 26.7% year-on-year (y-o-y) from S$3.0 billion in Q1 2020.

The residential sector retained momentum with some S$1.7 billion of investment deals at the start of 2021. The Good Class Bungalow (GCB) segment continued to draw strong interest due to its rarified and coveted status, as well as the entry of more family offices setting up in Singapore. The sale of a GCB at Nassim Road for S$128.8 million or S$4,005 per square foot (psf) on land in late March broke all previous sales records from this asset class.

At the same time, developers were beginning to replenish their land banks through partnerships, such as the collective sale of Surrey Point (S$47.8 million) by an Amara Holdings joint venture as well as the purchase of two residential plots at Institution Hill for S$33.6 million through a consortium comprising Macly Group, Roxy-Pacific Holdings and LWH Holdings.

Here’s more from Knight Frank:

Correspondingly, the commercial and shophouse sectors picked up pace in Q1 2021, recording some S$1.2 billion of investment deals. Major commercial sales included the acquisition of a 50% interest in OUE Bayfront by Allianz Real Estate for S$633.8 million and Certis Cisco Centre by RBC Investor Services Trust Singapore for S$150.0 million. Demand also came from strata offices and shophouses. Such notable deals included the transaction of shophouses at Teck Lim Road (S$22.3 million) and Mosque Street (S$21.5 million) as well as strata office units on the 22nd floor of The Central for S$41.7 million.

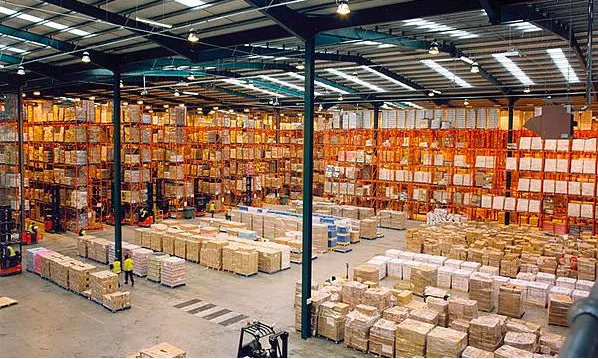

Bolstered by the transactions of the Breadtalk IHQ for S$118.0 million by Lian Beng Group and Sime Darby Business Centre for S$102.0 million by AIMS APAC REIT, the industrial sector registered more than double growth in the quarter, with about S$906.1 million of investment purchases. With e-commerce set to stay and grow beyond its current levels, the demand for logistic spaces is envisaged to continue to increase to cater to the expanding inventory. While economic recovery is on track, industrial space owners who are more cautious might restrategise and consider sale and leaseback options to generate liquidity.

Outbound investment from Singapore

Based on available data from Real Capital Analytics (RCA), some S$9.9 billion of outbound investment deals were recorded in the first quarter, increasing by 45.6% y-o-y from the same period last year. In light of accelerating digitalisation with the growing reliance on cloud technology and services as a result of the pandemic, data centres are thrust into the spotlight to meet this rising need. In Q1 2021, Ascendas REIT acquired a portfolio of 11 data centres in Europe for approximately S$904.6 million, in a move to expand and diversify into this resilient industry. During the same period, Mapletree Investments Pte Ltd won a land tender for S$139.3 million to develop a data centre in Fanling Sheung Shui Town in the New Territories, Hong Kong SAR. The data centre industry is envisaged to receive increased demand as digitalisation continues to be adopted and enhanced across industries.

Market outlook

As sentiments have generally improved across the globe, we envisage capital outflow to expand due to the availability of more opportunities overseas. In the local real estate market, while sales activity has picked up, the stock of investment properties put up on the market is limited as most sellers are holding on to their assets in anticipation that these properties would be able to fetch a better price in the near future given that economic recovery seems more certain. As such, the investment market is projected to see more partnerships, particularly in the purchase of land.

In 2021, interest and sales activity in the residential, commercial, industrial and shophouse sectors are expected to record continued growth due to the resilience and attractiveness of these assets despite external headwinds.

Advertise

Advertise