Singapore prime logistics rents up 2.2% in Q2

Business park rents dipped 0.5% during the quarter.

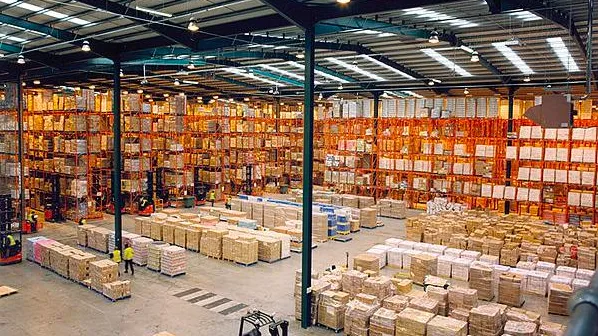

As industrial demand weakens, Cushman and Wakefield revealed in a recent report that rental growth in Singapore’s industrial market has started to diverge in Q2 2023, with varying performance across industrial segments. Property types with limited new supply are still seeing positive rental growth.

“Prime logistics rents grew 2.2% qoq, easing from previous quarter’s 7.5% qoq growth, as vacancy rates remain tight. Factory and warehouse rents held constant in the quarter, while rents of business parks in outlying areas declined slightly by 0.5% qoq,” the report said.

Here’s more from Cushman and Wakefield:

Older outlying business park developments are facing stronger pressure due to hybrid work and an influx of new supply. Meanwhile, high-tech properties and city fringe business parks rents rose by 0.3% qoq and 0.4% qoq respectively, supported by resilient demand from tech and life science occupiers. Science Park rents grew 0.7% qoq compared to 0.2% qoq growth in Q1 2023, though this was driven by higher rents at two developments.

More Investment Sales Opportunities

There could be more opportunities for industrial investment sales on the horizon. Given rising flight to quality and sustainability demand coupled with limited new industrial supply, there will be increasing interest for asset enhancements or redevelopments of ageing industrial assets. It may be timely for owner-occupiers to consider sale-and-leaseback arrangement or joint development.

Also, given the current high interest rate environment, there could potentially be more industrial opportunities on the market as REITs look to lower their gearing ratio. This could be an opportune time for prospective industrial investors, as availability of institutional grade industrial assets are limited.

Advertise

Advertise