Real estate leaders weigh in on the future of office

Around 100 attendees took part in the first-ever Commercial Real Estate Digital Conference.

The future of the office will have more flexible arrangements as businesses worldwide continue to adjust to changes in working options. Whilst going back to the office is expected by most, working remotely is also foreseen to stay.

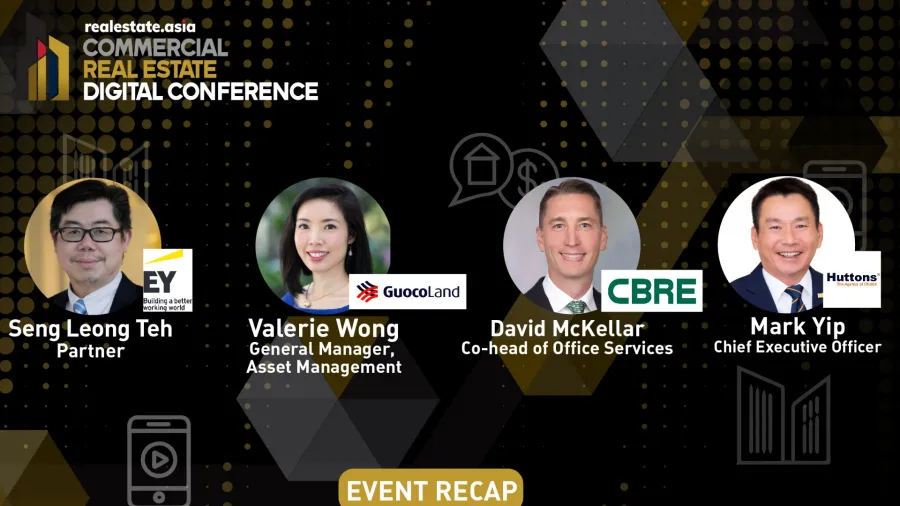

It is the role of offices to serve as an anchor or connector for employees to come together and collaborate. Primarily, the office will function as a magnet for people to interact, said EY Partner Seng Leong Teh in Realestate Asia’s “Commercial Real Estate Digital Conference” held last 8 June 2021.

“Work from home is not a fad, we think it is here to stay. There is productivity gain and there's value in work from home. Whilst we acknowledge the flaws associated with this, we believe that there is a need to change our way of thinking to make hybrid work effective,” he said.

Teh said that with the hybrid model, office will not just be a place to come to. Employees will come regularly either to socialize or to network.

“The future office requires a significant amount of investment, especially in technology. The office space is primarily used to collaborate and network with colleagues. As such, there needs to be a rethink about how officers are being organized,” he added.

Opening flexible arrangements for work will offer ways to ensure productivity from employees. CBRE Singapore Co-head of Office Services David McKellar said that this will benefit those who prefer to have separate office spaces when doing work.

“Dwelling sizes in Asia are small and Singapore homes are smaller than the Asia Pacific median. Inadequate workspace, distraction from family members and ambiguity of who bears the cost,” he said, are some of the challenges faced by those in work-from-home arrangements.

As commercial spaces adjust to changing needs of lessees, such as downsizing or having preference over shared amenities in buildings, the industry is seen to thrive in the coming years.

“The new supply pipeline is forecast to be 25% less for the next four years in comparison to the 10-year historical annual average. So long as Singapore remains an attractive place for companies to locate, we do not expect to see a glut of availability and rents will likely remain firm for the foreseeable future,” McKellar said, citing Singapore as an example.

“Towards the end of 2020, office demand was ramping up. Given Singapore's highly educated workforce, favorable business environment with low corporate and personal tax rates, and easy access to most major cities within a single flight, Singapore will continue to attract firms from all over the world that engage in business activities within Asia Pacific,” he added.

Constantly evolving commercial spaces

Real estate developers in the Asia Pacific region are gradually adapting to the changing needs of business when it comes to office spaces. GuocoLand is one of the companies that have adapted to this change early on, as can be seen from their recent projects in revamping GuocoTower and in the upcoming Guoco Midtown.

Valerie Wong, Asset Management General Manager for GuocoLand Limited, said that they adapted an integrated development connectivity for GuocoLand to F&B, amenities, and public spaces.

“The MRT stands over the basement concourse and it connects directly to GuocoTower. For the integrated development, there are public transport nodes and a way to connect them to the rest of the neighborhood. An employee could take the lift up to go to the hotel at level five, or through the urban park to reach various components of the retail and office tower,” she said.

GuocoMidtown’s highlight, which has a total of 770,000 sq ft of office space, is its Network Hub. The hub houses communal facilities and is directly connected to the main office tower.

“There are three main components: the office, the residential tower, and the retail, but we've also created a new concept that's called the Network Hub. It will house 40,000 square feet of spaces and communal minds facilities, and will connect directly into the main office tower,” Wong said.

“It's around 30,000 square feet per floor. An individual may go down to level two and cut across directly to the Network Hub. We have facilities for over 200 persons and spaces for meeting rooms. The rooftop also has a 40-metre swimming pool and houses private dining facilities,” she added.

By integrating lifestyle, leisure, and avenues for community-based spaces, these will help employees enjoy going back to the office and enjoy the flexibility of having to work within the area.

Developers adapt to changing needs

The changes in consumer demand for commercial and residential real estate will be key for developers to succeed in the next few years, according to Huttons Asia CEO Mark Yip.

As consumers prioritize budget concerns alongside how much space they need rather than want, developers will have to review their projects.

“The developer has taken that into consideration where they allow community spaces that are outside your units to enjoy. This presents a very good proposition from the developer point of view to the consumer like us taking this opportunity when prices are still in the affordable range,” he said.

“What do you need? From your current working condition and with current members staying within a home. Big or small, it is based on your own unique needs. That is the current condition in Singapore,” he added.

In order to properly assess what kind of developments should be offered, a closer study of the various segments is needed. These may include those who are staying with families, relocating to smaller homes, or even those who prefer to live nearer to their workplaces.

“We have to look at the various segments. Who are these buyers? We have the HDB upgraders in which we are aware that 80% of the population stays in HDB. Then we have another group of the buyers who have been staying in large homes and their children are grown up, so they would like to do what we call a downsize,” he said.

“It all boils down to affordability. In most key cities and central locations, residential prices have gone up. Small apartments here in Singapore, because of the limited scarcity of land and the development and labor costs, have risen in price. Developers will need to be mindful and must take this into consideration. Developers must learn how to build functional small rooms where you will have a decent corner, or places within your compound that can offer you a place to live, work and play,” he concluded.

Advertise

Advertise