Real Estate Asia: An Interview with KPMG in Singapore’s Tay Hong Beng

To cushion the effects of remote work, KPMG in Singapore’s Partner and Head of Real Estate suggests tweaking tax rates and adjusting the basis of taxation to the F&B, hospitality, retail, and aviation sectors.

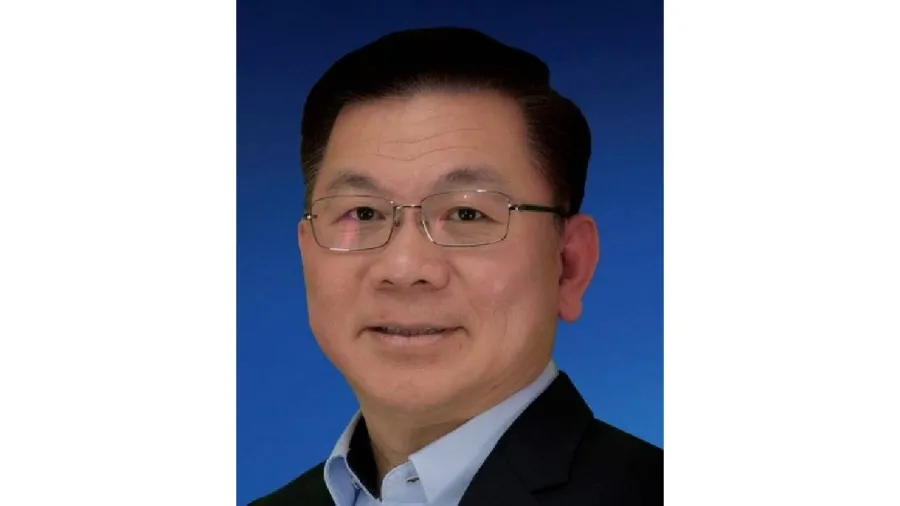

Hong Beng is the Head of Real Estate in KPMG in Singapore and KPMG’s Global Real Estate Steering Committee.

With more than 30 years of experience in tax consulting in the real estate and financial services sectors, he is heavily involved in advising businesses on complex tax issues that include structured transactions, merger and acquisition deals (including tax due diligence and pre-IPO restructuring), corporate restructuring, international tax planning, and investment projects.

Hong Beng has also participated as a key advisor to several high-profile real estate transactions and tax dispute resolution assignments in Singapore. He is a member of KPMG’s Global Real Estate Steering Committee and KPMG in Singapore’s Operations Committee. He is also a board member of the Singapore Institute of Accredited Tax Professionals. Aside from being a regular speaker at tax seminars, Hong Beng has also contributed numerous articles and commentaries on current and topical tax-related issues.

As one of the esteemed judges of Real Estate Asia 2021, Hong Beng sat down with us as he delved into the pandemic’s effects on the real estate industry. Furthermore, he talks about disruption in the traditional landlord-tenant model, and why a key trend to look forward to in real estate is property technology.

What do you think is the most important factor when judging real estate developments for the Real Estate Asia awards?

We are looking for companies with the potential to unlock new value through innovative developments. They are the change-makers driven to push the boundaries of usability, sustainability and safety, while accounting for the needs and requirements of occupiers, investors and regulators. The developments these companies are responsible for are also possibly strengthening social fabric with spaces that facilitate community bonding while adding colour and aesthetic appeal to the estate.

What can the real estate industry learn from the COVID-19 crisis? And for those who have been badly hit, what can owners do to jumpstart their recovery?

COVID-19 has introduced new parameters around personal health and working adaptability, and these are going to demand greater customisation in living and working spaces. While co-working and co-living spaces, as well as online marketplaces for lodging or vacation rentals have been around, the shift towards more personalisation will lead to a disruption in the traditional landlord-tenant model.

Landlords looking to thrive post-pandemic will have to take a more active view towards co-creating spaces with their tenants. This could involve conceptualising and implementing new design features and operating models suitable for work after COVID-19. For example, office landlords can provide more meeting and interaction spaces; retail landlords can provide a more experiential environment; while residential developers can make their architecture and interior designs conducive for occupants to work from home.

Landlords must also be willing to share the risks and rewards of their tenants’ businesses. For example, the use of data analytics by landlords can help their tenants understand the footfall and profile of customers. This will help landlords capitalise on technological innovations for business while making for a stronger landlord-tenant proposition in terms of the value provided.

What are the taxation challenges and opportunities during the pandemic? What about in real estate?

COVID-19 has accelerated the adoption of remote working and de-densification of the Central Business District. This has negatively impacted the F&B, hospitality, retail, and aviation sectors while positively impacting businesses providing services such as cloud and data that enable remote working.

Tax authorities can explore tweaking tax rates and adjusting the basis of taxation to recognise these impacts and cushion the operating costs.

Internationally, tax regulations can be streamlined to help businesses remotely hire targeted foreign talent. This will help businesses introduce intellectual capital, technical skills and tax dollars into Singapore while protecting the Singaporean core workforce.

Employment policies should also enable talent in Singapore to work in overseas markets while being physically located in Singapore. To enable this to happen at scale, the authorities could consider undertaking a comprehensive review of employment laws around the right to work for non-residents; tax provisions such as corporate tax, permanent establishment issues, transfer pricing and employers’ tax; social security and welfare laws, and laws regulating cybersecurity.

The pandemic has prompted a shift from large offices in the centre of the city to smaller work hubs in the suburbs and alternate CBD locations. A de-densification of the CBD will help in its regeneration and reduce our carbon footprint by cutting down daily commuting.

Authorities can incentivise developers and investors to develop net-zero buildings by providing enhanced tax deductions on financing costs, property tax rebates for green property owners, rebates on stamp duty on conveyancing of green properties and enhanced tax deductions on rental paid by tenants of green properties.

Which trends will define the real estate industry in the years to come?

The following five trends will be critical in defining the industry in the future:

1. Closer collaboration between landlords, occupiers and investors;

2. The growth of flexible workplaces and a shift away from the central business districts;

3. E-commerce and contactless sales leading to increased demand for smart warehousing and near sourcing;

4. Greater emphasis on sustainable buildings in response to demand from occupiers, regulators and investors; and

5. Extensive use of PropTech (Property Technology), Data Analytics and AI (Artificial Intelligence) across the real estate value chain.

Most importantly, authorities will need to work closely with industry leaders to understand the evolving demands of business and living needs. This is critical to ensure rules can be structured in a timely fashion to address sustainability goals while maximising the usage of land and resources.

Do you think technology has an enormous potential to disrupt the real estate industry in a significant way? If yes, what steps could be taken to lessen its negative impact?

Yes, we already see technology’s impact across the real estate value chain, and the effects have been predominantly positive. Buildings today are smarter, safer and more sustainable. Technology has made it possible to design and build bolder structures, minimise wastage during construction, reach remote buyers through VAR and provide predictive maintenance.

Greater adoption of technology does mean that some unskilled and semi-skilled roles may be automated in the future. Singapore can use technology to reduce its reliance on foreign labour and invest in developing its home-grown talent. A positive spinoff of this is the potential for more diversity in the construction sector’s workforce, such as more women joining.

What do you think is the future of real estate in Asia and the world?

In the short term, the real estate sector will undergo a period of adjustment due to the impact of the pandemic and the push to drive sustainability. This may include repurposing certain asset classes; generating fresh ideas for assets; and tapping into new sources of funding.

In the medium to long term, developers and landlords will evolve along with the changing demands of occupiers and consumers. PropTech will likely be increasingly leveraged to create new products and climate-friendly operating models that are focused on the well-being of occupants. This will give rise to new investable asset classes and possibly new financial products.

Advertise

Advertise