APAC logistics rents to rise by around 3% this year

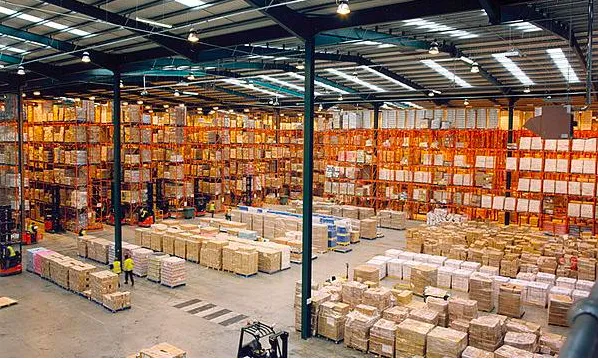

Strong warehouse demand from e-commerce platforms is driving robust leasing activity in APAC.

CBRE reveals that Q2 2020 brought a mild improvement in industrial sentiment in Asia Pacific along with the resumption of industrial activity. Purchasing Managers Indexes(PMIs) for the region’s major economies all rose in June, with Mainland China, Australia and Vietnam seeing a return to expansionary territory.

The pandemic has served as a catalyst for stronger warehouse demand from e-commerce related platforms, according to CBRE. Together with requirements from grocery and pharmaceutical companies seeking cold/mixed storage space, this has supported a sharp rebound in leasing activity in Mainland China and helped ensure the resilient performance of logistics markets in Japan and Korea.

Weaker demand has been observed from export-related occupiers. Optimism generated from the signing of the “phase-one” U.S.-China trade deal has been completely negated by the widespread disruption resulting from the pandemic, with rising geopolitical tension between China and several other countries adding another layer of uncertainty.

The overall picture for the Asia Pacific logistics market nevertheless remains upbeat, with strong leasing demand expected to ensure regional vacancy remains low and providing a solid foundation for rents. However, growth momentum will be mild owing to occupiers’ sensitivity around costs and the ample new supply pipeline. Rents in most markets are expected to increase at or around 3.0% this year, in line with previous forecasts issued in May.

Leasing activity in Singapore has been supported by stockpiling demand from the government following the introduction of the ‘Circuit Breaker’ measures in April; inventory storage requirements due to weaker exports; and last-mile logistics expansion. Prime logistics properties in the west and east of the city-state are near full occupancy and demand has begun to spill over to lower-specification logistics space. This has prompted us to revise our full-year rental growth forecasts from -8.5% to 5.2%.

Hong Kong SAR will be the main laggard in terms of rental performance, with a further correction expected over H2 2020. More occupiers in the city are seeking cost-saving relocations or downsizing moves amid downbeat economic conditions and muted trading activity.

Advertise

Advertise