Prime yields in Melbourne's industrial sector hit record low of 4.56%

The average prime yield midpoint in Melbourne compressed by 25 bps in 4Q20.

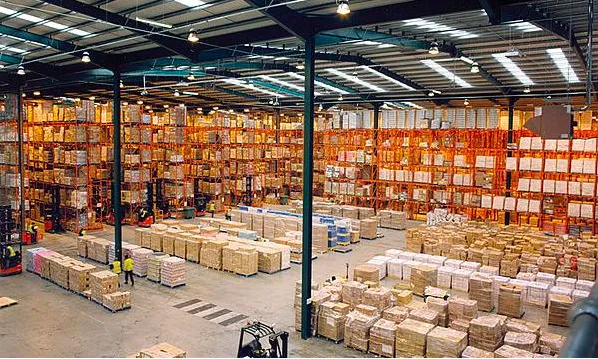

Government mandated lockdown restrictions continued to be eased as Victoria moves past its second wave of COVID-19, thus occupier movement has accelerated. According to JLL, gross take-up (for occupier moves >5,000 sqm) totalled 470,200 sqm – the highest total that JLL has recorded for the Melbourne market and the eighth consecutive quarter of demand exceeding the 10-year quarterly average of 182,700 sqm.

In line with long term occupier trends, activity was concentrated in the Transport, Postal and Warehousing (39%), Manufacturing (27%) and Retail Trade (17%) sectors, which accounted for 83% of gross take-up for the quarter. The North precinct recorded two lease deals of greater than 89,000 sqm, which contributed to it recording 53% of total demand in 4Q20.

Supply delivery remains above average, spurred by pre-commitments

A total of eight projects reached practical completion in Melbourne over 4Q20, adding a total of 236,500 sqm of new stock to the market. Although this is 22% below the 3Q20 total, it is more than double the 10-year quarterly average of 112,700 sqm. Supply delivery was concentrated in the West (49%) and North (38%) precincts, reflective of their less restrictive land supply environments.

The strong development pipeline in the Melbourne market has been spurred by a strong pre-leasing market, which has seen over 1.3 million sqm of stock pre-committed since the start of 2019 – substantially higher than the previous two years (546,800 sqm). As such, the supply delivered in the quarter was 96% pre-committed – significantly outperforming the average over the last 10 years (81%).

Strong transaction volumes continue to support price growth

The average prime yield midpoint in Melbourne compressed by 25 bps in 4Q20, to a new record low of 4.56%, bringing the full-year compression to 52 bps. Sharpening of prime yields has come off the back of continued activity in the investment markets, with AUD 626.1 million of sales occurring in 4Q20 – 92% above the 10-year average and the highest single-quarter total since 2Q17.

Despite recording significant occupier activity over the course of 2020, there has been relatively little growth in rents. This continued in 4Q20, as the market average increased 0.1% q-o-q to AUD 94 per sqm per annum due to some increases reported in the South East. The ongoing subdued rental growth is primarily a result of the volume of supply, which is providing competition to existing assets.

Outlook: Structural tailwinds to continue to support activity

The delivery of new stock to the Melbourne market is expected to remain substantial over the course of 2021, with 816,500 sqm of supply due to complete over the next 12 months. Given the strength of the pre-commitment market in Melbourne, there is scope for an increase in development activity, provided that an anchor tenant can be signed ahead of commencing construction.

Whilst the situation surrounding the COVID-19 pandemic remains fluid, the continued strong public health response from the state government has managed to keep the economy open since the end of the second wave in October. The broader outlook for the state will rely heavily on continuing to suppress the virus and the capacity for the economy to remain open.

Note: Melbourne Industrial refers to Melbourne's industrial market (all grades).

Advertise

Advertise