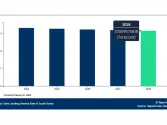

Australia’s residential property listings drop to a record 200,000

Listings ranged between 300,000-380,000 properties between 2011 and 2019.

A recent release by the Real Estate Institute of Australia (REIA) says stamp duty has become the antiquated blight of the Australian housing sector as prices soar and governments continue to penalise home buyers with higher taxes which is leading to a reduced number of properties on the market.

According to the latest market analysis by REIA and SQM Research, listings have plummeted across the country as housing prices and taxes on sales skyrocket.

According to the report, total national property listings have been steadily falling over the past year to currently sit at just over 200,000 properties – a record low on SQM’s numbers.

By way of comparison, between 2011 and 2019, a period that recorded two upturns and one downturn, national available listings ranged between 380,000 to 300,000 dwellings.

“As a result, market liquidity has nearly halved. In 2008, up to 4.5% of all residential properties were available for sale at any one point in the market. Today the percentage available is below 2.5%,” the report found.

REIA President, Adrian Kelly said stamp duty remains a prohibitive tax for all buyers, adding tens of thousands of dollars to the purchase of a home – for empty nesters, paying tens of thousands of dollars on a home they may only need for five years means less properties will be placed on the market.

“Stamp duties as a percentage of average national earnings have jumped over the past decade to 34.3% from 25.1% recorded back in 2012, up almost one third. In Sydney and Melbourne, stamp duties alone can represent nearly half the average annual income,” Mr Kelly said.

Mr Kelly said transfer duties as a percentage of median property prices have jumped in most capital cities over the nine years between the March quarter of 2011 and March 2021 because of rising property prices.

“First home buyers are borrowing more to accommodate higher stamp duties and affordability is reducing.

“In real terms, at current median income and rising housing prices, had stamp duty remained at the 2012 amount, home buyers would save an average nation-wide of $21,000 with Victorians saving a whopping $35,000, or half an annual median salary in Australia,” Mr Kelly said.

Louis Christopher, Managing Director of SQM Research stated, “Our study has found there has been an ongoing decline in listings over the past ten years. The decline in listings has been occurring despite the steady increases in total dwellings across Australia and even through the various housing cycles.

“The long-term decline in listings fundamentally represents a shortage of real estate which is contributing factor to the surge in prices.

“While there may be various reasons for this situation, we believe stamp duty bracket creep is a leading contributor. When transaction costs of transferring properties disproportionately rise compared to dwelling prices and incomes, (as what we have found) then that must be a massive disincentive for property owners to move house,” Mr Christopher said.

Advertise

Advertise