Singapore’s office sector still a landlord’s market

The office rental index surged by 11.7% in 2022.

The office rental index increased by 5.1% q-o-q in Q4 2022, following the 2.1% q-o-q growth in Q3 2022, according to a Knight Frank report.

Overall, the office rental index has surged by 11.7% y-o-y in 2022. This increase can be attributed to businesses actively seeking quality office space throughout the year, in order to support the full resumption of functions to pre-pandemic levels and to meet the operational needs of a normalising economy, the report added.

Here’s more from Knight Frank:

In Q4 2022, occupancy levels increased to 88.7% in Q4 2022 from 88.3% in Q3, supported by steady demand for traditional as well as co-working space with net new demand for the year totalling 473,612 sf, the first year since 2020 at the onset of the pandemic that office absorption was reported to be in positive territory. As at Q4 2022, the office sector remains a landlord’s market, despite the troubles in the tech sector as well as the prevailing economic pessimism.

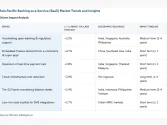

The robust hiring activity recorded in Q2 and Q3 2022 on the back of easing pandemic restrictions took a turn in Q4 with several technology companies announcing employee layoffs both locally and globally. Despite this, the government has just reported that non-technology companies such as those in the banking and finance, hospitality, logistics and retail sectors have begun to tap these talents. As Singapore continues to position as an international hub with established sophisticated financial and legal structures, businesses on the growth path are still looking to expand headcount, albeit cautiously.

Slower growth of 0.5% to 2.5% is expected in 2023 caused by inflation as well as volatility in the technology sector. Furthermore, the spillover of the downside risk of an economic slowdown may see some businesses turning conservative and right-size their current office footprints. However, demand in the year ahead is likely to be sustained by corporates shifting business functions from other parts of Asia with Singapore as a flight-to-safety destination as uncertainty grows.

International firms poised to gain from the receding pandemic in growth regions such as South-East Asia are also looking to set up or expand in the city-state from which to reach the steadily growing middle class in these countries. With these sources of demand and with IOI Central Boulevard Towers the only substantial new office development completing in the CBD next year, rents are likely to increase moderately by around 3% for the whole of 2023, barring any further substantial pre-termination or reduction of space from technology companies.

Advertise

Advertise