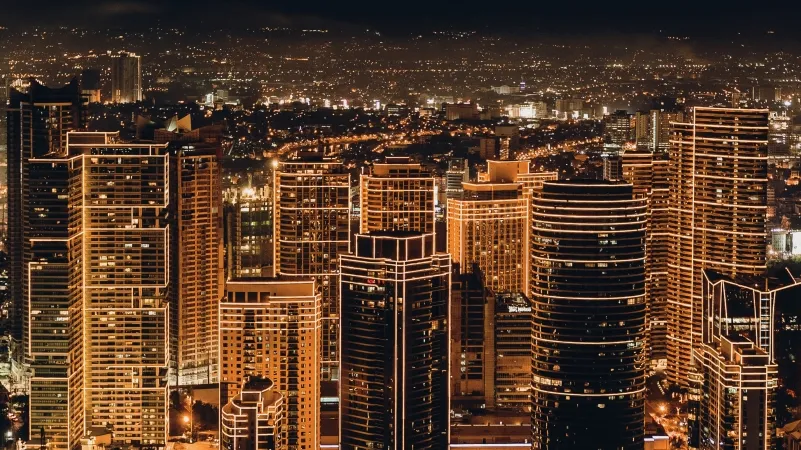

Luxury retail projects to watch out for in the Philippines

The 30,000-sqm Mitsukoshi Mall is slated to open in Q4 2022.

Luxury brands are primarily located in prime locations in Metro Manila. Savills says several upscale projects have been completed in recent years including Greenbelt 3 (24,800 sq m, GLA) which has been redeveloped into a high-end establishment, housing fashion houses such as Chanel, Dior, Fendi, Celine, and Ermenegildo Zegna. The latter two were new tenants for the mall since its reopening.

While some brands have maintained a similar scale to their old presence, Savills notes that many brands such as Hermes and Louis Vuitton have taken this opportunity to extend their footprint in the mall, often doubling or tripling their previous store size.

Here’s more from Savills:

Another prime project which excites the market is the Mitsukoshi Mall (30,000 sq m) at Federal Land’s Grand Central Park community in Bonifacio Global City, which is expected to open in Q4/2022.

Isetan Mitsukoshi Holdings, owner and operator of Japan’s famous department store chain, is set to open its first retail-cum-residential project in the Philippines in partnership with Federal Land and Nomura Real Estate Development. The four-story retail mall will feature a high-end supermarket and food hall (known as Depachika) as its anchor tenant, as well as housing an outstanding selection of boutiques carrying Japanese brands and other global luxury labels.

Policy support is another demand driver for the retail market. The retail trade liberalisation law was recently amended to make it easier for foreign brands to enter the market.

To engage or invest in the retail business, a foreign retailer: (a) shall have a minimum paid-up capital of PHP25 million (roughly US$250k) (formerly US$2.5 million); (b) its country of origin does not prohibit entry of Filipino retailers; and (c) in the case of foreign retailers engaged in retail trade through more than one physical store, the minimum investment per store has been reduced to at least PHP10 million (roughly US$200k) (formerly US$830,000).

In terms of rental performance, prime retail rents in Metro Manila have dropped by 9.5% over the past two years. On average, prime retail rents have corrected from PHP 2,489 per sq m per month in 2H/2019 to PHP 2,254 per sq m per month in 2H/2021. All in all, market sentiment has continued to improve, however, as the economy has begun to rebound, though the uncertainties of the pandemic may yet cloud the outlook in the near term.

Advertise

Advertise