New Delhi records 4.4m sq ft of warehousing and industrial leases in 2020

3PLs and e-commerce firms were the primary demand drivers in H2 2020.

The warehousing and logistics segments benefitted from a shift in consumption behaviour towards online purchases during the pandemic, with Delhi NCR recording a robust 3.1 msf of warehousing and industrial leases during the second half of 2020 while the year closed at 4.4 msf, according to Cushman & Wakefield.

Third-party logistics and e-commerce firms were the primary demand drivers for warehousing spaces in H2 2020 with an average transaction size of 0.13 msf. Ecom Express, TVS Logistics, Delhivery, Safexpress, BigBasket, Grofers and Amazon leased large warehousing spaces in Haryana in micro-markets including Sidhrawali, Bhaproda,Tauru Road, Farukhnagar and Sonipat during H2.

Here’s more from Cushman & Wakefield:

Flipkart acquired a 140-acre land parcel from Haryana State Industrial & Infrastructure Development Corporation (HSIIDC) to set up their largest fulfilment centre in Asia in Manesar. In another large land allotment, Japan’s Amperex Technology acquired a 180-acre land parcel in IMT Sohna through a bidding conducted by HSIIDC to bolster its manufacturing presence in the country.

Companies setting up their manufacturing facilities and warehouses in Haryana will lend a huge impetus to the state’s warehousing and logistics sector. Noida’s industrial sector also witnessed traction with allotments of 92 industrial plots in Phase II by Noida Authority during H2 2020. Greater Noida and Yamuna Expressway regions are likely to see increased activity with the development of Jewar Airport; Yamuna Expressway Industrial Development Authority made more than 900 land allotments for industries in the region during the year.

Organized developments and greater institutionalization key features on the supply side

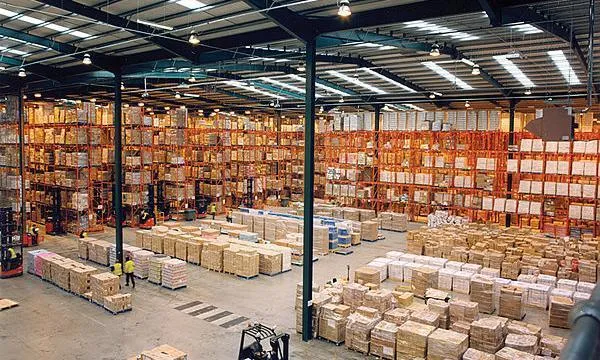

Completed and upcoming Grade A developments by organized players including Embassy, IndoSpace, Logos, Ascendas, Allcargo Logistics and ESR (in a strategic tie-up with Future Group) are being increasingly sought after by large occupiers with preference for Built-To-Suit facilities. Private equity investments backing many of these developments will take the hitherto unorganized warehousing segment to increased levels of institutionalization. Singapore-based CapitalLand is also in discussions for a large warehouse development in Sohna in a joint venture model, while IndoSpace is in the process of acquiring a land parcel in Gurugram.

Quality construction by large developers backed by several modern warehousing amenities have been pivotal in the massive transformation of this segment. Demand for such spaces with even more enhancements, including multi-tier, automated facilities and especially in the cold storage space, is bound to accelerate further as the country begins its vaccination drive to combat COVID and consumption for perishable foods rises significantly through the online route.

Industrial and warehousing rents largely stable

Industrial rents remained largely range-bound across submarkets in Haryana, Uttar Pradesh and Rajasthan. However, IMT Manesar with several auto-ancillary units recorded an 8-10% softening in industrial rents with demand being hit by the slowdown in the auto sector with COVID disrupting sales and supply chains. Additional supply in this corridor also added to the rental softening. Warehousing rents also remained unchanged in H2 2020; there was, however a 6% increase on a y-o-y basis given the robust demand. Land prices remained largely stable in H2.

Advertise

Advertise