Singapore’s 2021 residential leasing volume hits highest level since 1999

Leasing volume increased 6.5% y-o-y to 98,569 in 2021

It is no surprise for the final quarter of 2021 to be a lull period for the residential sector with the year-end festivities and school holidays. Singapore’s residential leasing volume declined 13.5% QoQ to 23,489 transactions in the quarter, after two consecutive quarters of increase.

On a YoY basis, Savills adds that the number of rental contracts for Q4/2021 was also slightly lower by 1.5% than the same period a year ago.

Here’s more from Savills:

Leasing volume of both landed and non-landed residential units fell in the quarter, with the number of rental contracts for landed homes declining by a larger 31.8% QoQ, compared to the 10.5% decrease for leasing volume of non-landed residential properties. Out of the three market segments for non-landed homes, the CCR was the most resilient, as the QoQ decline in leasing volume was the lowest (-7.4%).

The number of rental contracts in both RCR and Outside Central Region (OCR) fell 12.0% and 11.9% QoQ respectively in the quarter. While leasing volume may have decreased due to seasonality effects, leasing demand is expected to increase in the subsequent quarters with the easing of borders and higher Additional Buyer’s Stamp Duty (ABSD) rates, which may lead to more renting homes while waiting for their homes to be completed.

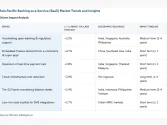

Out of the top five non-landed projects with the highest number of leasing transactions in Q4/2021, only City Square Residences is in RCR while the remaining four developments are located in CCR, signalling the popularity and resilience of residential properties that are centrally located. This may be fuelled by the ramp up in hiring by the firms in the information technology sector, which may lead to more expatriates or workers leasing homes in/near to their workplace in the Central Business District.

In Q4/2021, bulk, or over 70% of the rental transactions in these top five projects were for the smaller bedroom types, ie. One- and two-bedroom units. Two-bedroom units comprised 38.0% of the total leasing transactions in these five projects, while one-bedroom units constituted 36.4%. For two-bedroom units, this proportion in the final quarter of the year was around 10.0 ppts higher than that in Q3/2021 (27.7%).

As some companies may still continue on certain forms of working-from-home arrangements, workers may prefer homes with slightly larger spaces, or a separate room for working aside from their bedroom. Similar to the upward movement in rents islandwide, there was an increase in median rents in these top five popular projects as well.

For the whole of 2021, leasing volume totalled 98,569, up 6.5% from 2020 and the highest since the data was published from 1999. This was also a rebound from the 1.5% contraction recorded in 2020. The YoY surge in rental transactions in 2021 came as construction delays continued to plague the residential market and easing of border restrictions.

These demand drivers led to higher leasing demand as homeowners sell off their properties amid the robust residential market while waiting for their new homes to complete, as well as more entering Singapore with the progressive reopening of Singapore’s borders.

Advertise

Advertise