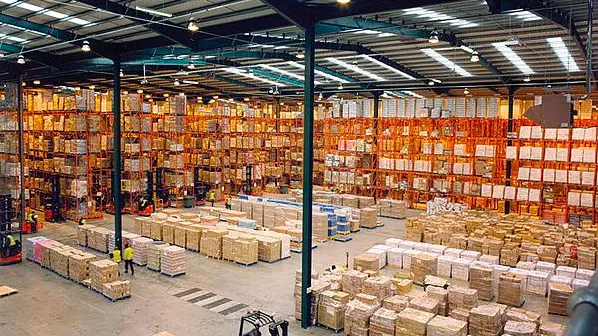

Hong Kong overall warehouse rents rebound 1.4% in Q4 2021

Vacancies declined to 3.1% in the same period.

A recent Savills report reveals that the local logistics sector, particularly aviation logistics, has benefitted from the strong performance of the trading and retail sectors. Total merchandise trade and retail sales rebounded by 26.0% and 8.5% respectively over the first ten months of 2021.

With air cargo movements least affected by border restrictions, Savills adds that local air cargo throughputs rebounded significantly by 13.0% from January to November 2021 YoY, while container throughput also stabilized over the same period.

Here’s more from Savills:

Faced with improving business prospects, many logistics operators, in particular those involved in aviation logistics and local retailers, were keen to renew their leases in ramp-access warehouses in the Kwai Tsing area, where we saw modern warehouses such as ATL, HLC and Mapletree all recording sizable renewals over the quarter.

Other logistics operators, which saw their business growing in buoyant market conditions, decided to expand and relocate. Having won a new logistics project from a large local corporate, Kerry Logistics leased the 158,000-sq ft Sunhing HungKai Tuen Mun Godown, which is close to both the River Trade Terminal and Tuen Mun-Chek Lap Kok Tunnel, for consolidation and expansion.

The enbloc of Mineron Centre in Fanling (150,000 sq ft), which was just purchased by CR Logistics in Q3, was reported to be leased in its entirety to Hi-Speed Logistics, another fast-growing logistics operator consolidating and expanding their operations in Hong Kong.

As such, overall and modern warehouse rents continued to rebound by 1.4% and 2.7% in Q4/2021 respectively, while both overall and modern warehouse vacancy rates declined to 3.1% and 2.6% over the same quarter.

Investment sentiment cautious due to external uncertainties

Investment sentiment dipped in Q4 as changing Mainland policies, and a turbulent stock market turned most investors cautious. Nevertheless, the rental prospects of logistics assets and the redevelopment potential of industrial premises have continued to attract foreign funds and local investors to the industrial segment. The most significant deals were the acquisition of two 4S (Sales, Service, Spare parts and Surveys) premises in Hung Hom and Chai Wan, both leased to Zung Fu, by the Link REIT for a combined HK$5.82 billion, which provided a stable 3.3% yield.

Less optimistic investment sentiment has translated into transaction volumes, with industrial transactions over October and November recording 486 deals, 22.5% lower than the 627 deals completed in July and August. Flatted factory prices were stable in Q4/2021 as a result, while warehouse prices rose more modestly by 1.8% over the same period.

Advertise

Advertise