Sydney industrial transaction volumes hit a record AUD1.32b in 4Q21

This is 161% higher than the 10-year quarterly average of AUD504.5m.

Limited asset delivery, above-average occupier activity and growing land values, have applied upward pressure on Sydney’s industrial rental rates.

According to JLL, prime rental rates grew across all precincts in 4Q21, with the Outer South West experiencing the most significant growth at 3.61% (q-q). In the secondary market, the Outer Central West produced the strongest quarterly growth (4.9%).

Here’s more from JLL:

Transaction volumes increased sharply to AUD 1.32 billion, a level 161% greater than the 10-year quarterly average (AUD 504.5 million). This quarter’s transaction volumes were the highest on record for the second consecutive quarter. New development sites accounted for 78% of transaction volumes. Investment transactions accounted for 17%, a significant decrease relative to the prior six months.

Take-up from logistics sector reaches record high in Sydney

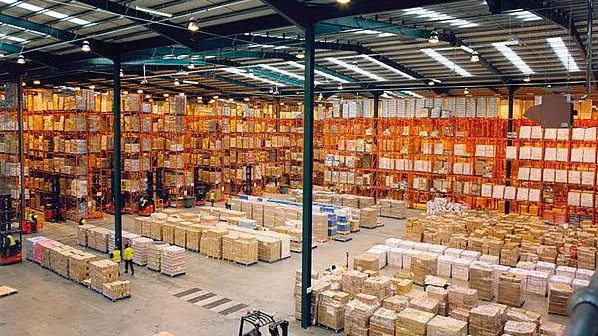

Occupier activity in the Sydney industrial market was above the 10-year quarterly average for the seventh consecutive quarter in 4Q21, totalling 293,400 sqm. Whilst this was a 23% decline q-o-q, it is still 33% above the 10-year quarterly average (221,000 sqm).

Demand was led by the transport, postal and warehousing sector, which accounted for 47% (138,600 sqm) of total take-up in the Sydney market. This illustrates the continuing impacts that logistics and supply chain challenges are having upon the industrial sector.

Assets under construction will deliver a supply record in 2022

Three projects reached practical completion this quarter, totalling 63,500 sqm of new stock, 49% below the 10-year quarterly average. Declining land availability in key precincts is restricting activity. A number of projects that were due to complete this quarter were delayed as a result of subsequent impacts from COVID-19-related construction industry shutdowns and have been pushed to 1Q22.

We are currently tracking 951,100 sqm of stock which is under construction in the Sydney industrial market, 67% of which has been pre-committed to. Over the next six months, 552,000 sqm of completions are due to come to market, although availability is limited with 70% of stock already pre-committed.

Outlook: Supply delivery and occupier activity to remain elevated

Demand has remained elevated despite continued pandemic issues. Supply delivery is expected to increase sharply with pre-commitment levels of 55% over 2022, with most stock being delivered in the Outer Central West. The existing structural tailwinds and sustained level of investor demand will likely support confidence and activity in the Sydney industrial market despite Omicron disruptions.

Robust investor demand continues to be displayed for assets in the Sydney logistics and industrial market. Yields are expected to remain relatively stable in the short-to-mid term following two record breaking quarters of investment volumes. Yields are expected to remain at record low levels for longer than previous cycles, supported by record-low bond rates.

Note: Sydney Logistics & Industrial refers to Sydney's industrial market (all grades).

Advertise

Advertise