How real estate companies can take advantage of data centre demand

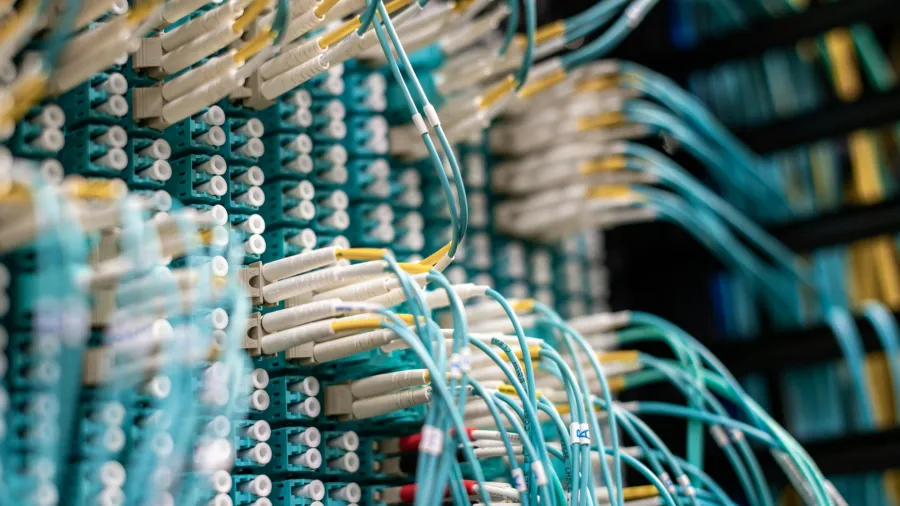

Risks include fibre-based network infrastructure availability.

As data centre critical IT demand is projected to reach 170 to 220 gigawatts (GW) by 2030, McKinsey’s senior partner Pankaj Sachdeva has outlined steps for real estate companies to take advantage of the supply-constrained market.

He started by segmenting companies into three: those who buy and lease land, those who partially develop land and then sell, and those who buy, fully develop and sell.

In the pure land play, Sachdeva said companies that gradually bring capacity online commission a project of 50 to 100 megawatts (MW) every two years. Much of this depends on how much capital they have and when tenancy commences.

For companies in the second category, they only build 50 to 70% of the capacity. This results in a need to buy from third parties, creating opportunities for real estate companies.

Companies that fully build data centres are banking on the supply-constrained market and are starting to see leases of ten-plus years, though the average is around seven years.

However, Sachdeva noted that risks include fibre-based network infrastructure availability and cooling systems’ sturdiness.

Furthermore, there is no anticipation that real estate players or data centre developers will face major yield compressions over the long term.

Advertise

Advertise