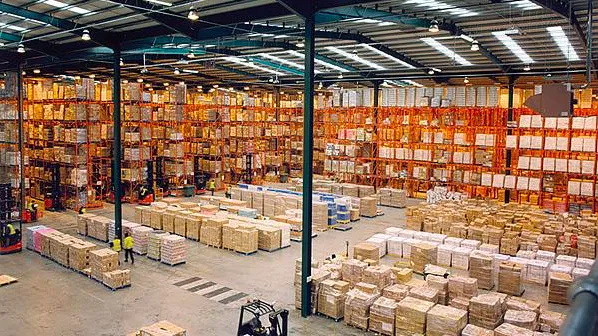

Thailand warehouse supply up 9.3% to 5.6m sqm in H1

Nearly half of this supply is in the Bangkok Metropolitan Region.

According to Knight Frank, the total supply of ready-built warehouses in Thailand reached 5.57 million sq m in H1 2023, an increase of 203,150 sq m of warehouse space compared to H2 2022. This addition represented a growth of 3.8% H-o-H and 9.3% Y-o-Y.

The new supply included MP Warehouse (Nong Yai Bu), KR Warehouse close to Pinthong 3 Industrial Estate, Namyong at WHA Chonburi Industrial Estate 1 in Chonburi, Bangkok Free Trade Zone 4 in Chachengsao, and Bangkok Free Trade Zone 6 in Samutprakarn.

Here’s more from Knight Frank:

Supply Distribution

The distribution of ready-built warehouses in Thailand is primarily divided among three key regions. The largest sub-market is the Bangkok Metropolitan Region, holding a 45% share of the total market. In this area, Samutprakarn commands the largest portion at 40%, while Bangkok contributes 3%. The Eastern Seaboard serves as the second-largest sub-market, comprising 38% of the overall warehouse supply.

Chonburi takes the lead with a 24% share, followed by Chachoengsao at 9%. In the central region, Ayutthaya, functioning as a significant hub for domestic logistics, represents 13% of the entire speculative warehouse space in the country, followed by Pathumthani at 3%.

In H1 2023, there was a consistent rise in supply across major sub-markets. The net leasable area in the Bangkok Metropolitan Region, experienced a 2.8% H-o-H increase, reaching 2.5 million sq m. The Eastern Seaboard followed closely with the most rapid expansion this half-year at 5.5%, reaching almost 2.1 million sq m. Lastly, the Central and other region saw a moderate supply growth of 3.0% H-o-H, totaling 944,700 sq m.

Advertise

Advertise