Indian residential market to rebound within six months; Bengaluru and Chennai to lead the recovery

Demand for homes in the affordable and mid segments is expected to drive the market.

According to JLL's Homebuyer Preference Survey, Indian homebuyers' desire to own a house is stronger now than ever before as people were left with no choice but to spend time indoors due to the strict lockdown and social distancing restrictions.

However, JLL notes that the residential market was disrupted by the pandemic with homebuyers going into pause mode during the lockdown months. Consumer sentiments and perception drive high-ticket purchases such as residential apartments. In the current fragile employment scenario and an atmosphere of subdued economic sentiment, survival became the priority. Homebuyers are either anxious about job security or anticipating salary cuts, which resulted in consumer sentiments taking a massive hit. Additionally, prospective buyers are expecting further drop in house prices. These led to home purchase decisions being postponed.

There is increased pent-up demand in the market, but this will translate into higher sales only when the economy stabilizes and prospective buyers feel secure about their jobs.

So, when can we expect the recovery process to start? Activity levels have definitely increased, but there is still some way to go before green shoots of recovery are visible. This being said, it is important to point out that even though the current business environment and consumer sentiments remain volatile, homebuyers remain cautiously optimistic about the future. The recovery process is expected to start in the last quarter of the year with the onset of the festive season and more than half of the prospective buyers returning to the market within six months.

Interestingly, a comparison of salaried with selfemployed individuals indicates that the latter has deferred home purchase plans by a longer duration. This may be attributed to the greater economic impact of the lockdown on self-employed individuals.

Similarly, it was observed that a greater proportion of people in the age group of 20-35 years deferred their home purchase plans by more than six months, while people who were above 35 years in age were more inclined towards buying a property in the next six months.

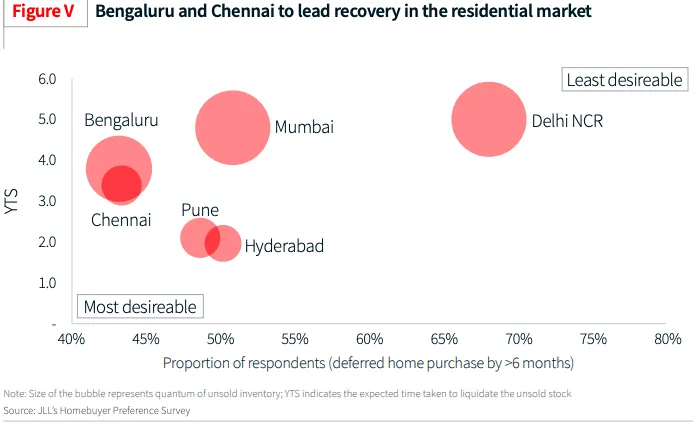

The markets of Hyderabad, Pune and Chennai provide indications of relatively healthy inventory management in terms of average construction period and YTS (years to sell). Further analysis reveals that the greenshoots of recovery might appear first in the southern markets of Bengaluru and Chennai. The larger markets of Delhi NCR and Mumbai have high levels of unsold inventory in various stages of construction as well as greater YTS due to a prolonged slowdown in sales. The proportion of prospective homebuyers who deferred their home purchase decisions by more than 6 months is also higher in these larger markets, which are areas of concern.

A majority of the prospective homebuyers indicated a preference for properties in the sub INR 50 lakh and INR 50-75 lakh category. Moreover, 65% of the buyers in these price segments indicated that they would return to the market within the next 6 months.

In terms of configuration, more than 50% of the prospective homebuyers indicated a preference to buy a 2BHK apartment with size ranging from 800 sq ft to 1000 sq ft.

On the supply side, developers have also realigned their products, with 60% of the new launches in the past two years falling in the INR 50 lakh and INR 50-75 lakh price segments. The alignment of demand and supply will support the recovery process and it is expected that the affordable and mid-price segments will continue to witness maximum traction in the post COVID era as well.

Click here for the full report.

Advertise

Advertise